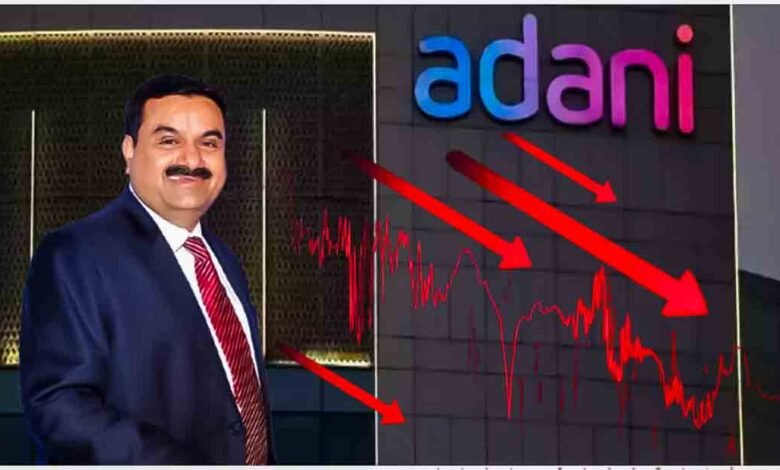

Adani Stock Crash: Allegations Shake Indian Markets

In a dramatic turn of events, the Indian stock market experienced significant turmoil following allegations against Gautam Adani, Chairman of the Adani Group. Reports from New York’s public prosecutor revealed that Adani is accused of paying a substantial bribe amounting to Rs 2,029 crore (equivalent to $265 million) to secure contracts for solar power supply. This revelation has led to a steep decline in the shares of several Adani Group companies, with some stocks witnessing a drop of up to 20%.

Heavy Impact on Stock Market Indices

The allegations triggered immediate repercussions in the Indian stock market. The major indices, Sensex and Nifty, both reflected the widespread uncertainty and concern among investors, showing significant declines as the market responded to the early morning news. The sudden dip in the market has resulted in the loss of over Rs 2 lakh crore in investor wealth, a substantial hit to the economy.

Adani Group Shares Plunge Up to 20%

Among the hardest hit were the shares of Adani Enterprises, the flagship company of the conglomerate, which suffered a 20% drop. This was closely followed by a 19.17% fall in Adani Green Energy, a company accused of engaging in unethical practices to obtain solar energy contracts. Other Adani Group entities were similarly affected:

- Adani Total Gas: Fell by 18.14%

- Adani Power: Dropped by 17.79%

- Adani Ports: Saw a decline of 15%

- Ambuja Cements: Shares fell by 14.99%

- ACC: Witnessed a decrease of 14.54%

- NDTV: Recorded a drop of 14.37%

- Adani Wilmar: Slid by 10%

Worst Performance Since Hindenburg Report

This sharp decline in Adani Group’s stocks marks the worst performance for the conglomerate since the publication of the Hindenburg Report in January 2023, which had previously raised questions about the financial practices of the group. Today’s news, however, has deepened the crisis, as the allegations include both financial misconduct and alleged losses to American investors.

Accusations of Bribery for Solar Contracts

The core of the accusation revolves around an alleged bribe of Rs 2,029 crore, reportedly paid by Gautam Adani, his nephew Sagar Adani, and seven other individuals. The money was allegedly used to sway government officials in India, granting the Adani Group lucrative solar power contracts. The fallout from these allegations is not just impacting the Indian market but is also causing ripples internationally, as American investors claim losses linked to Adani’s business practices.

Market Analysts Express Concern

Financial analysts have expressed concern over the long-term implications of this controversy on the stability of the Indian stock market. With the Adani Group’s vast influence across multiple sectors, any prolonged impact could lead to further economic uncertainties. Experts suggest investors remain cautious and closely monitor developments in the coming days as the allegations are investigated.