RBI Holds Repo Rate Steady at 6.5% for the 10th Time, Prioritizing Inflation Control

RBI Monetary Policy Update:

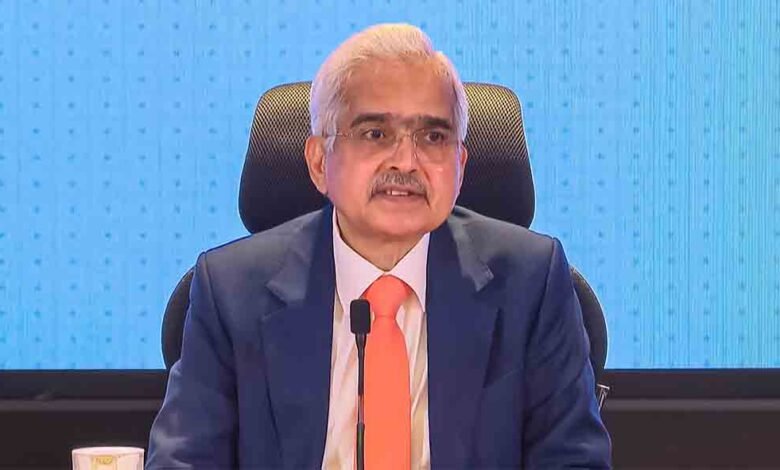

The Reserve Bank of India (RBI) has once again decided to keep the benchmark repo rate unchanged at 6.5%, marking the 10th consecutive meeting where the central bank has maintained this rate. The decision, taken at the Monetary Policy Committee (MPC) meeting on Wednesday, reflects the RBI’s ongoing focus on controlling inflation while ensuring balanced economic growth.

Governor Shaktikanta Das, in his address, emphasized that the MPC’s decision was made with a majority vote, with five out of six members supporting the current policy stance. The Sustainable Deposit Facility (SDF) rate was kept at 6.25%, and the Marginal Standing Facility (MSF) rate remained at 6.75%, along with the savings rate.

RBI’s Balanced Approach to Inflation and Growth

The central bank’s decision highlights a shift toward a more neutral monetary policy stance, focusing on controlling inflation risks without undermining economic growth. Governor Das reiterated that the RBI’s objective remains achieving stable inflation within the target range of 2-6%, while fostering sustainable economic expansion.

“The MPC decided that monetary policy positions will shift to neutral, focusing on inflation objectives consistent with sustainable growth,” Governor Das stated. This shift demonstrates the RBI’s commitment to adjusting its policy as inflationary pressures rise, particularly in the face of global uncertainties such as geopolitical tensions and volatile oil prices.

Inflation Pressures and Global Economic Uncertainty

With India’s All India Consumer Price Index (CPI) inflation rising to 3.65% in August, and food inflation climbing to 5.65%, above the RBI’s medium-term target, inflation risks remain a key concern. The central bank’s cautious approach is aimed at curbing these pressures while keeping an eye on the broader economic landscape.

Despite the challenges posed by rising food prices and global uncertainties, the RBI remains committed to supporting the country’s economic recovery in the post-pandemic environment. Governor Das noted that the bank will continue monitoring inflation and growth dynamics closely to guide future policy decisions.

Implications for India’s Economic Growth

The MPC’s focus on inflation control while balancing economic growth comes at a time when global uncertainties, such as fluctuating oil prices and geopolitical tensions, are affecting the Indian economy. The RBI’s steady approach with its repo rate policy will be critical as India navigates these global economic challenges.

The repo rate serves as a key instrument for controlling inflation and regulating liquidity in the economy, and maintaining it at 6.5% signals that the RBI is taking a cautious approach while ensuring that inflation does not spiral out of control.

Looking Ahead: What’s Next for RBI’s Monetary Policy?

As India faces inflationary pressures, particularly from rising food prices, the RBI’s focus on inflation targets will shape future monetary policy decisions. The Monetary Policy Committee (MPC) will continue to assess both inflation trends and economic growth prospects, ensuring that India remains on a path of sustainable recovery.

With the RBI’s decision to keep the repo rate steady, businesses, investors, and consumers alike will be watching closely as the central bank navigates inflationary pressures and global economic uncertainties.